How Leaders Are Using Business to Advance Race Equity

-2.jpg)

Building racial equity is crucial for the United State’s future and Net Impact is helping to drive meaningful conversations.

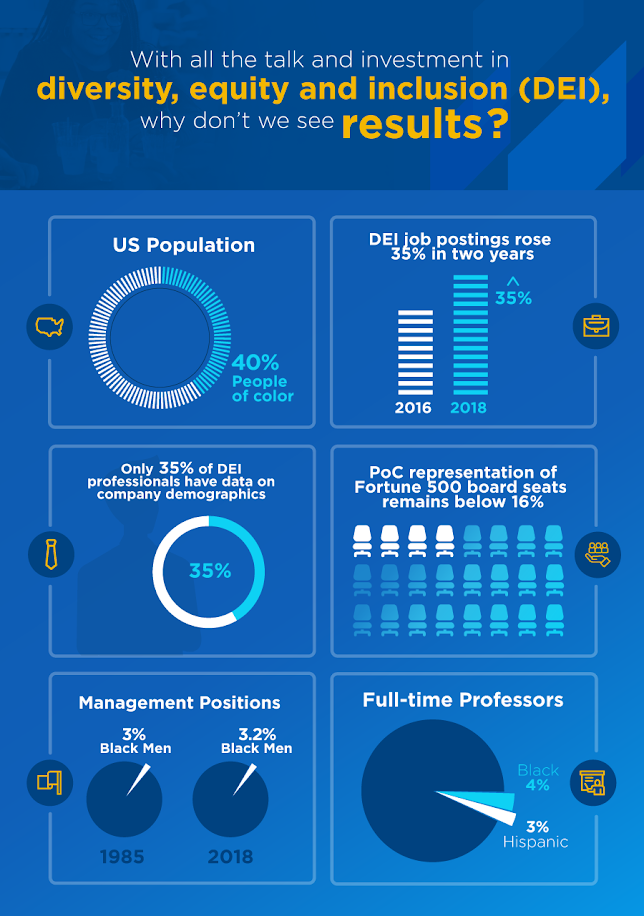

As fields such as impact investing and corporate responsibility continue to rapidly grow, racial inequity is inextricably connected to nearly every social challenge that these organizations seek to address, such as quality healthcare, affordable housing, access to better education, and access to financial capital. More companies than ever are bringing diversity to the forefront if their strategies, increasing human capital and dedicating resources to improving practices. In March 2018, the job site Indeed reported that postings for diversity and inclusion professionals had risen 35% in the previous two years.

Although a growing number of business leaders agree that diversity is important in building a strong organization, the actual outcomes are not growing at the same rate. With all the talk and investment in diversity, equity, and inclusion, why don’t we see results? People of color– who make up nearly 40% of the U.S. population– remain acutely underrepresented in most influential fields. People of color only held about 16% of Fortune 500 board seats in 2018.

The racial gap available capital is reflected in, and affected by, another disparity—one that extends to the investment profession. A US Government Accountability Office report documents the point: Investment firms owned by women and people of color manage less than one percent of the $70 trillion in assets under management in the United States, even though women and people of color make up about 70 percent of the US population. This is particularly striking in the private equity industry, where firms owned by people of color represent only 3.7 percent of the industry and manage only 3.4 percent of industry assets.

Throughout the past few weeks, Net Impact hosted a series of online discussions, “Investing in Racial Equity: Digital Conversation Series”, exploring some of these big questions facing the intersection of Impact Investing and racial equity, today. Each conversation features a different leader in the field with whom participants can engage in conversation about their experiential perspective in the field of impact investing and racial equity.

“How is impact investing making a difference?” “What challenges exist and what are successful impact investing models that advance racial equity?” “How can you make a difference and play a role as a young graduate who is interested in entering this field?”

Investing in Racial Equity

The first conversation in our series took place on November 18 with Net Impact’s CEO, Peter Lupoff, and Randy Strickland of Cornerstone Capital Group. It was a dynamic conversation that introduced the historical context of racial inequity in the U.S. and then went on to engage our callers around key questions that began to unpeel the layers of this complex issue.

“Impact investing and social ventures will not cure the ills of racism on their own,” reflected on one chapter leader from the University of Rochester. “But in this day and age, we have the opportunity to leverage our networks and band together to ensure that women and minorities are gaining access to the capital they need to succeed without having to utilize larger funding sources who are more focused on short-term profit than the mission of impact.”

Nadia Brigham, a former Racial Equity Program Officer at the W. Kellogg Foundation, and currently the founder and leader of Brigham Consulting shared her reflections on opportunities for advancing racial equity in our second discussion on January 22. Nadia tempered these opportunities with the challenges that continue to exist and our individual and collective role in overcoming these challenges together.

"Because of how [our country] was created, the structures we put in place for this experiment, there is not one single area for which racial equity is not pertinent, whether you’re talking about housing, education, criminal justice, it’s everywhere, it’s the air we breathe, it’s in the DNA of the country,” Brigham said.

Ready to join the conversation?

The third conversation in the series will take place on February 28, featuring Ellis Carr, the President, and CEO of Capital Impact Partners. Facilitated by Nadia Brigham, this conversation with Ellis will explore perceived “risks” in the investing space and examine successful models of investment that are aimed at advancing racial equity. To participate, please RSVP using this link.

Take the next step and start a conversation with your community, using #investinginracialequity and tagging @NetImpact on social.

-3.jpg?width=352&name=backpacks-college-college-students-1454360%20(1)-3.jpg)